Burial Insurance With COPD: The Ultimate 2025 Guide to Affordable Coverage

Last Updated: November 14, 2025 | Written by President of Term Life Online – AU, AAI, ARM

|

If you’re living with COPD, finding affordable burial insurance can feel overwhelming — especially when many insurers treat COPD as "high-risk." But here’s the truth: you can get burial insurance with COPD, and in many cases, you can qualify without a medical exam, without being denied, and without paying outrageous rates. This guide breaks down everything you need to know — how underwriting works, which insurance types approve COPD applicants, how to avoid the companies that overcharge, and the exact steps to lock in the cheapest rate possible. |

|

What Is Burial Insurance (Final Expense) for COPD?

Burial insurance — also called final expense insurance — is a small, affordable whole life policy designed to cover funeral, burial, and end-of-life costs. Unlike traditional life insurance, it:

- Requires no medical exam

- Approves most people with health issues

- Offers instant, lifelong coverage

- Provides death benefits typically ranging from $5,000 to $25,000

For people with COPD, burial insurance is often the easiest and most dependable form of coverage available.

Can You Get Burial Insurance If You Have COPD?

Yes, absolutely.

Whether you have mild, moderate, or severe COPD — approval is still possible.

What matters is how your condition is managed:

- Mild to moderate COPD: You can often qualify for Level/Preferred plans with immediate coverage.

- Advanced COPD: You may still qualify, but with Graded or Guaranteed Issue plans.

- COPD with oxygen use: Guaranteed Issue (no health questions) is typically the only option.

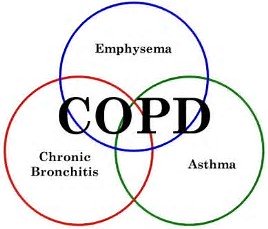

What is COPD?

COPD is Congestive Obstructive Pulmonary Disease which may include several different respiratory disorders; such as, chronic bronchitis and emphysema. It is a progressive disease that makes it difficult to breathe. Its gets worse over time.

COPD is a chronic inflammatory lung disease that causes obstructed airflow from the lungs.

Symptoms of COPD include coughing, wheezing, shortness of breath, and tightness in the chest. The leading cause of COPD is smoking. Quitting smoking may improve your chances of not developing this disease.

It’s caused by long-term exposure to irritating gases or particulate matter, most often from smoking cigarettes. People with COPD are at increased risk of developing heart disease, lung cancer and other health conditions.

COPD is the third leading cause of death in America and a major cause of disability.

Common Causes of COPD include:

- Smoking

- Air Pollution

- Dust

- Chemical Fumes

Source: Mayo Clinic

Best Types of Burial Insurance for People With COPD

1. Level Benefit Plans (Best Option)

- Immediate coverage (no waiting period)

- Lowest premium pricing

- For applicants with mild COPD symptoms who do not use oxygen

2. Graded Benefit Plans

- Partial benefits during the first 24 months

- For applicants with moderate COPD, inhalers, or recent flare-ups

3. Guaranteed Issue Plans (Last Resort—but still valuable)

- No health questions

- Everyone gets approved, including those on oxygen

- Full benefits after 24 months

How COPD Affects Burial Insurance Rates

Insurers increase pricing for COPD because it is a chronic respiratory illness. But the increase is far smaller with final expense companies than with traditional life insurance.

Your rate will depend on:

- Severity of COPD

- Tobacco use

- Prescription history

- Oxygen use

- Age & gender

- Past hospitalizations

Pro tip: Not all insurance companies treat COPD the same. Choosing the right carrier can save you 30–60% instantly.

Average Burial Insurance Rates for People With COPD

(These are sample ranges—your exact rate may vary.)

Age 50

- Level: $35–$55/month

- Graded: $45–$75/month

- Guaranteed Issue: $60–$90/month

Age 60

- Level: $45–$75/month

- Graded: $60–$95/month

- Guaranteed Issue: $75–$120/month

Age 70

- Level: $75–$120/month

- Graded: $95–$150/month

- Guaranteed Issue: $120–$180/month

Best Insurance Companies for COPD Burial Insurance (2025)

While pricing varies by state and carrier, these insurers traditionally offer strong COPD approvals:

- Mutual of Omaha (Guaranteed Acceptance) – Very competitive for mild COPD

- Gerber Life (Guaranteed Issue) – Best for severe COPD or oxygen use

- American Amicable – Great for moderate COPD

What to Avoid When Buying Burial Insurance with COPD

To keep costs low and avoid mistakes:

❌ Don’t buy from companies that only offer Guaranteed Issue

❌ Don’t apply before comparing underwriting guidelines

❌ Don’t assume you’ll be denied — most people are approved

❌ Don’t wait, because premiums increase every year you age

How to Get the Lowest Rate for Burial Insurance with COPD

Here’s how to secure the cheapest possible policy:

1. Work With an Independent Agency

They compare multiple companies to find the one with the best COPD guidelines.

2. Be Honest About Your Health

You can still get approved with inhalers, steroids, prednisone, or flare-ups.

3. Apply Before Your Next Birthday

Your rate drops instantly just by applying sooner.

4. Choose a Whole Life Policy (Not Term)

Term life usually declines COPD applicants.

FAQ: Burial Insurance with COPD

1. Can I get burial insurance if I have COPD?

Yes. People with COPD — mild, moderate, or severe — can still qualify for burial insurance. Many carriers offer policies with no medical exam, no labs, and guaranteed approval even if you're on oxygen.

2. Does COPD make burial insurance more expensive?

Generally, yes. COPD is viewed as a higher-risk condition, so premiums are slightly higher. However, the right insurer can reduce your cost significantly, sometimes by 30–60%.

3. Can I get immediate-coverage burial insurance with COPD?

If you have mild to moderate COPD and no oxygen use, you may qualify for a Level Benefit plan with day-one coverage. If you have advanced COPD or use oxygen, you may need a Guaranteed Issue plan with a waiting period.

4. Do I need a medical exam?

No. Burial insurance for COPD is always no-exam. Insurers only use your health questions and medication history to determine eligibility.

5. What if I use oxygen for my COPD?

You can still get covered, but your only option is typically a Guaranteed Issue policy. These policies approve 100% of applicants regardless of health conditions.

6. Which companies are best for burial insurance with COPD?

Carriers known for favorable COPD underwriting include Mutual of Omaha, Aetna Accendo, Royal Neighbors of America, American Amicable, and Gerber Life (best for oxygen use).

7. How much burial insurance do I need if I have COPD?

Most families choose between $10,000 and $20,000 to cover funeral costs, cremation or burial, medical bills, and final expenses.

8. How fast does coverage begin?

For Level plans, coverage begins immediately. Graded and Guaranteed Issue plans typically have a 24-month waiting period for natural causes.

Conclusion: Burial Insurance with COPD Is Absolutely Possible

COPD does NOT prevent you from getting affordable final expense coverage. Whether your symptoms are mild or severe, there is a policy available — often without medical exams, doctor’s visits, or strict underwriting.

With the right plan, you can:

- Protect your family

- Lock in rates for life

- Gain immediate peace of mind

- Ensure your final expenses are always covered

Guaranteed Issue Burial Life Insurance Quotes

Top Pick – United of Omaha

United of Omaha offers guaranteed acceptance whole life insurance for people age 45 to 85. Choose $3,000 up to $25,000 of coverage. Rates start as low as $8.80 per month. There’s no medical exam and no health questions. You cannot be turned down. You can get a quote and apply online now. Start Here to get a FREE Quote.

Highly Recommended – Gerber Life

Gerber Life offers guaranteed acceptance whole life insurance for people age 50 to 80. Choose from $3,000 up to $25,000 of coverage. Rates start as low as $17.69 per month. There’s no medical exam and no health questions asked. You cannot be turned down. START HERE to get a FREE Quote.

Resources:

- What is Burial Insurance?

- Can I Buy Burial Insurance for My Parents?

- Can You Buy Burial Insurance on Someone Else?

- Life Insurance Quote for Someone with COPD

- Life Insurance for Seniors Living with COPD

- Tips for Buying Guaranteed Acceptance Life Insurance

- Guaranteed Acceptance Life Insurance FAQs

- Pros and Cons of Buying Guaranteed Acceptance Life Insurance

- A.M. Best Company: Compare financial strength ratings of life insurance companies

- Life Happens.org: Learn about life insurance and review facts.

About Our Methodology

Reviewed By: President of Term Life Online – AU, AAI, ARM

- 30+ years of experience in insurance planning

How We Keep This Guide Accurate: We regularly updates our content to reflect the latest rates and industry trends. We are committed to providing transparent, unbiased information to help you make the best decision for your family.

At Term-Life-Online.com We value your trust and privacy.

End of Life Insurance | Burial Insurance Direct

Disclaimer: This is for informational purposes only. Consult a licensed professional for advice.

Disclosure: Compensated Affiliate